Issue B2B crypto cards for teams, suppliers, and platforms.

Vircard helps businesses issue virtual and physical cards backed by cryptocurrencies and stablecoins. Pay suppliers, manage employee expenses, and move money across borders from a single platform.

Designed for finance teams, corporate treasurers, and product leaders who need cards that speak crypto and settle in fiat.

Crypto in, fiat out, without changing how your business pays.

B2B crypto cards let your company hold digital assets while paying suppliers and employees in familiar currencies. Vircard connects your wallets to global payment networks and automates conversion in the background.

Payment conversion

When your business makes a purchase, the crypto or stablecoin balance is converted into fiat currency at the point of sale. The vendor receives local currency and you manage exposure in digital assets.

Stablecoin backing

Card programs can be backed by stablecoins that track assets such as the US dollar. This helps keep day to day business spend predictable while you operate with digital assets.

Card formats

Issue virtual cards for online spend and physical cards for field teams. Add them to Apple Pay and Google Pay for smooth in person payments worldwide.

Where B2B crypto cards fit inside your company.

Replace manual conversions, fragmented bank accounts, and personal cards with one controlled program that runs on top of your crypto treasury.

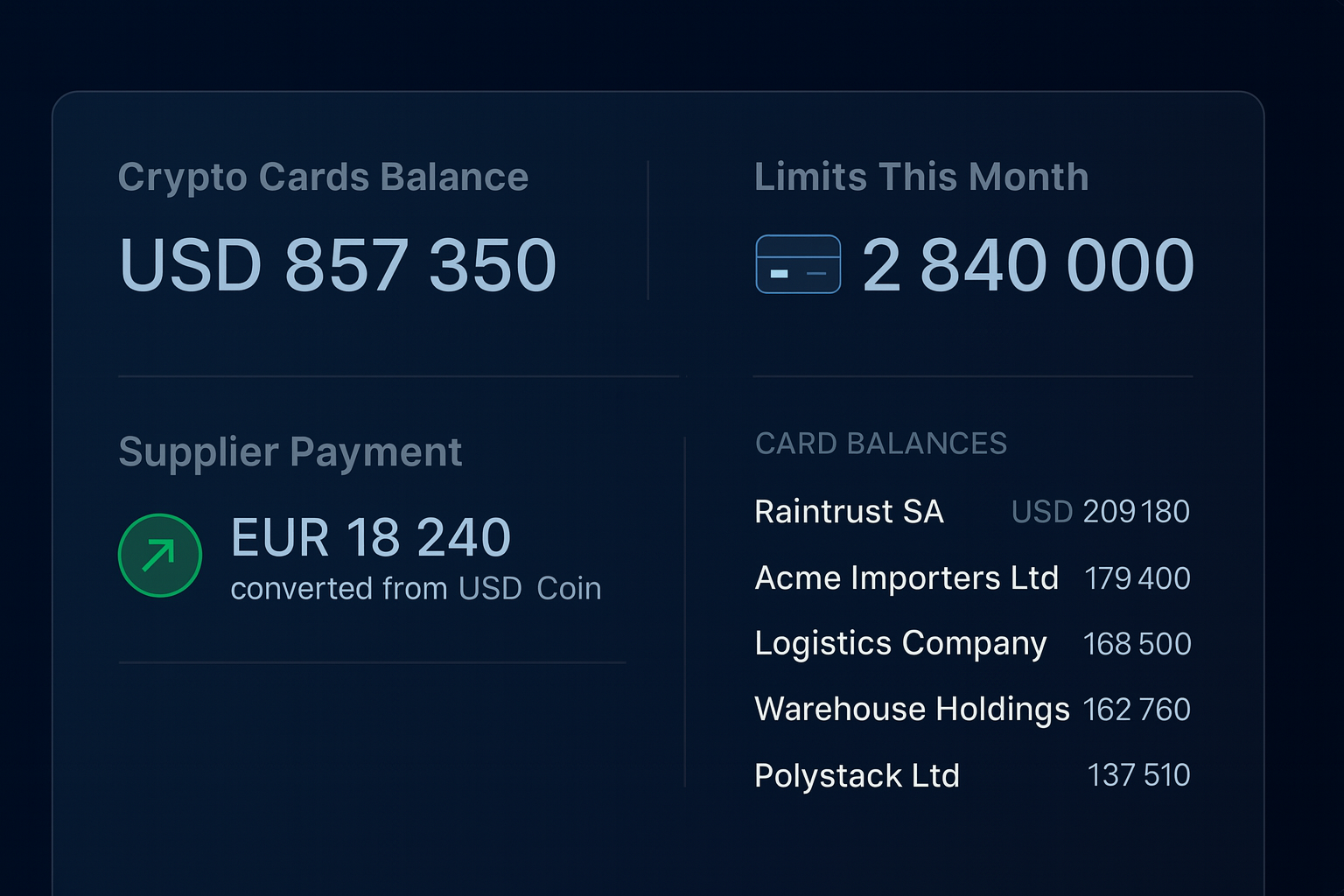

Supplier payments

Pay vendors directly from a crypto wallet by issuing supplier cards with limits per project or contract. Funds convert automatically so suppliers receive the currency they expect.

Employee expenses

Create cards for travel, marketing, remote teams, or subscriptions. Define rules by team or employee and keep all spend mapped to your digital asset balances.

Cross border payments

Move value across borders without slow settlement chains. Cards can be used in multiple regions while crypto and stablecoins help reduce friction and fees.

Customer rewards and partner programs.

Built for finance, compliance, and growth teams.

From cost control and cashback to compliance and fraud monitoring, Vircard helps companies run a serious card program on top of their crypto activity.

Cost and fees

Manage conversion and foreign exchange fees in one place, with clear reporting. Some programs can offer reduced fees for high volume clients or specific corridors.

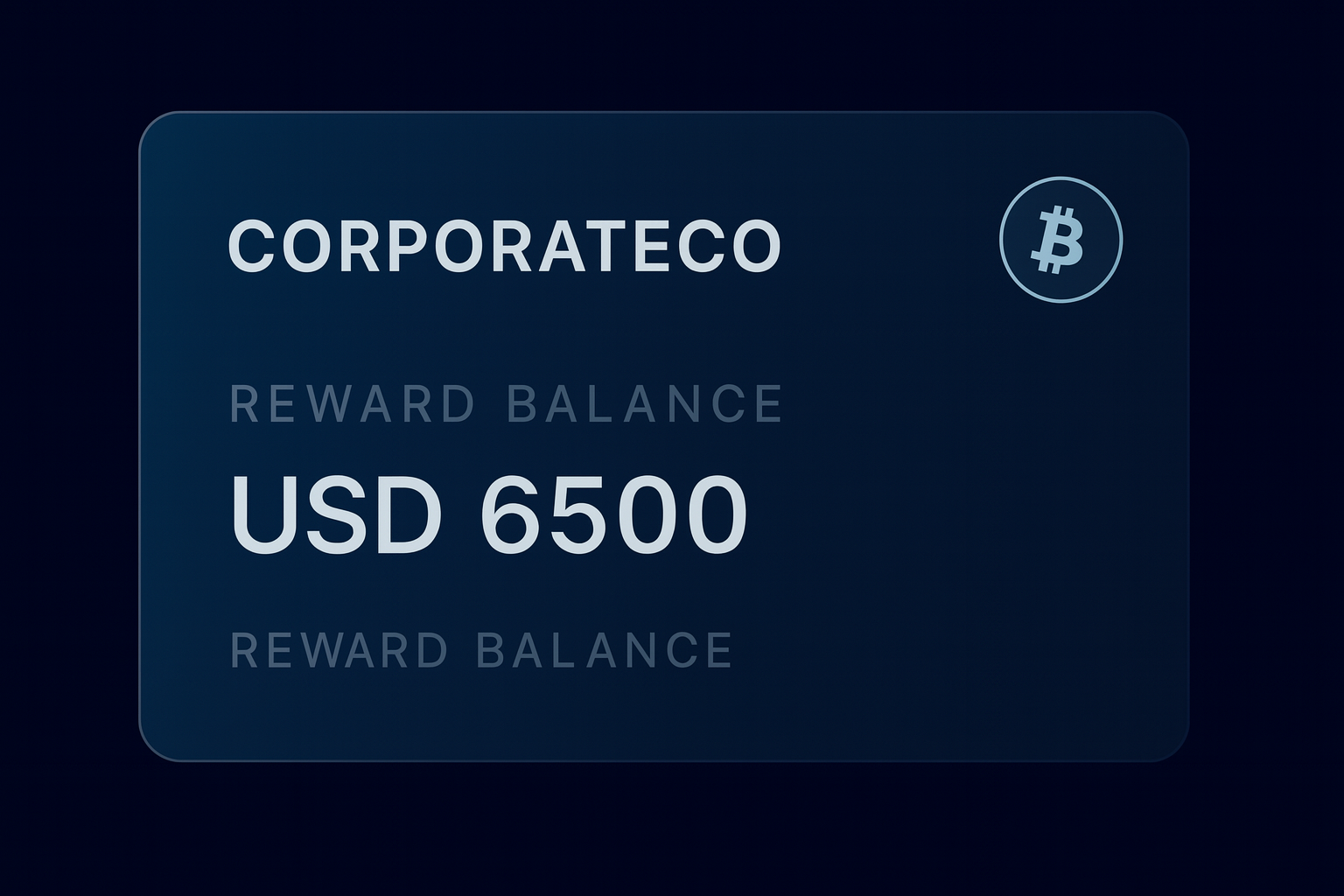

Cashback and incentives

Offer cashback based on spend, merchant types, or VIP level. Rewards can be settled in fiat, stablecoins, or tokens, aligned with your business model.

Compliance and fraud

Work with partners that understand KYC, AML, and sanctions requirements. Monitoring, limits, and controls are built into the card stack with support for network rules.

Global reach

Run a single program that can serve multiple regions. Design card types such as prepaid, debit, or credit and adapt to local requirements while keeping control of your crypto treasury.

Program design

Work with experts to choose card types, define rewards, and design cardholder journeys. Use their playbooks and Vircard infrastructure to launch faster with less risk.

Card issuing and controls through modern APIs.

Integrate Vircard into your platform to create, manage, and monitor B2B crypto cards at scale. Use APIs to treat cards as programmable objects that follow your own business logic.

Ready to explore B2B crypto cards for your business.

Share a few details and our team will follow up with a short call to map your use cases, compliance needs, and technical setup.